Title: Exclusions and Inclusions: What You Need to Know About Car Insurance Policies in Australia

Introduction

Understanding the inclusions and exclusions of your car insurance policy is crucial for ensuring that you have the right coverage to protect your vehicle and financial well-being. In Australia, car insurance policies vary in terms of what they cover and what they exclude. In this guide, we will explore the common inclusions and exclusions in car insurance policies to help you make informed decisions when selecting coverage.

1. Inclusions in Car Insurance Policies

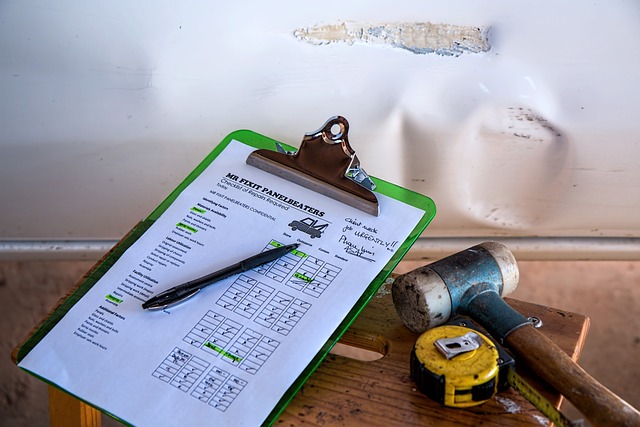

- Accidental Damage: Car insurance policies generally cover accidental damage to your vehicle resulting from collisions or other unforeseen events.

- Theft and Vandalism: Coverage for theft and vandalism protects you in the event your vehicle is stolen or maliciously damaged.

- Third-Party Liability: Car insurance policies in Australia typically include third-party liability coverage, which protects you financially if you cause damage to someone else’s property or injure someone in an accident.

- Legal Liability: Car insurance policies often cover legal liability costs, including legal expenses and compensation for third-party injury or property damage caused by an insured vehicle.

- Emergency Repairs: Some policies provide coverage for emergency repairs, such as towing and roadside assistance, to ensure you can quickly address issues and get back on the road.

- New Car Replacement: Certain policies offer new car replacement coverage, which provides a replacement vehicle if your insured car is written off within a specific period after purchase.

2. Exclusions in Car Insurance Policies

- General Wear and Tear: Car insurance policies typically exclude coverage for general wear and tear, as this is considered a result of regular vehicle use and maintenance.

- Mechanical or Electrical Breakdown: Coverage for mechanical or electrical breakdown is generally excluded from car insurance policies. It’s important to maintain your vehicle properly to minimize the risk of breakdowns.

- Intentional Damage: Car insurance policies do not cover intentional damage caused by the policyholder or anyone acting on their behalf.

- Driving Under the Influence: Any damage or accidents that occur while driving under the influence of alcohol or drugs are typically excluded from coverage.

- Racing or Reckless Driving: Car insurance policies often exclude coverage for damage or accidents that occur during racing, reckless driving, or participation in illegal activities.

- Unlicensed or Unauthorized Drivers: If an unlicensed or unauthorized driver is operating the vehicle at the time of an accident, coverage may be excluded.

- Commercial Use: Personal car insurance policies generally exclude coverage for vehicles used for commercial purposes. Separate commercial insurance is typically required for such vehicles.

- 3. Windscreen and Glass Coverage

Many car insurance policies in Australia include coverage for windscreen and glass damage. This coverage helps repair or replace damaged windscreens or windows due to accidents, vandalism, or other covered events. However, there may be specific conditions or limitations regarding the extent of coverage or excess amounts applicable.

4. Personal Belongings

Some car insurance policies provide coverage for personal belongings that are stolen or damaged while inside the insured vehicle. This coverage typically has a specific limit, and certain items may be excluded or require additional documentation for proof of ownership.

5. Additional Optional Coverages

Car insurance policies often offer additional optional coverages that you can add to your policy for an extra premium. These may include:

- Rental Car Coverage: This coverage provides reimbursement for the cost of a rental car if your insured vehicle is being repaired due to a covered event.

- Roadside Assistance: Roadside assistance coverage offers services such as towing, battery jump-start, lockout assistance, and fuel delivery in case of breakdowns or emergencies.

- Hire Car after Theft: If your insured vehicle is stolen, this coverage provides a rental car for a specified period until your vehicle is recovered or replaced.

- Windscreen Excess Buyout: This optional coverage allows you to reduce or eliminate the excess amount applicable to windscreen or glass claims.

It’s important to carefully consider these optional coverages and assess whether they align with your needs and budget.

6. Policy Limitations and Conditions

Car insurance policies may have specific limitations and conditions that affect coverage. These can include:

- Excess Amount: The excess is the amount you need to contribute towards a claim. It can be a fixed amount or a percentage of the claim value. Understand your excess obligations as outlined in your policy.

- Policy Limits: Car insurance policies may have limits on the maximum amount payable for certain types of claims, such as third-party liability or property damage. Ensure these limits are sufficient for your needs.

- Driver Restrictions: Some policies impose driver restrictions, such as age limits or exclusions for drivers with certain license types or driving histories. Make sure you comply with these restrictions to maintain coverage.

- Policy Renewal and Changes: Understand the terms and conditions related to policy renewal, changes in coverage, and the process for notifying the insurer about any modifications or updates to your vehicle or circumstances.

Conclusion

Being aware of the inclusions, exclusions, and optional coverages in your car insurance policy is essential for understanding the extent of your coverage and ensuring it meets your needs. While inclusions often cover accidental damage, theft, liability, emergency repairs, and windscreen damage, exclusions commonly include wear and tear, breakdowns, intentional damage, and driving under the influence. Optional coverages such as rental car coverage, roadside assistance, and windscreen excess buyout can provide added protection and convenience. Be sure to review the policy limitations and conditions, including excess amounts, policy limits, driver restrictions, and renewal processes. Understanding these aspects will help you make informed decisions and ensure you have the right car insurance coverage in Australia.